Bills. Meet Clean.

Insanely simple bill management.

We get it. It’s hard to be profoundly passionate about paying bills. We thought the task could use some love. So we gave it some.

Track expenses versus income, categorize transactions, and receive personalized insights for optimal savings on bills.

Personal Bills

Find ways to save on your monthly bills such as cable, cell phone and electricity. Learn how to negotiate any bill and stay tune as we build ways to manage bills online.

Company Bills

Managing bills is one of the key pillars for any successful business. If you are a small business owner, there are several things you can do to reduce your bills and stay within budget. We teach you all the tricks. Also, make sure to check out our reviews on the different business payments platform.

Saving

Find easy ways to save on every day items. Our savings tools and expert advice is available 24/7 in our content mall. We’re also integrating automatic savings based on your monthly payment transaction history. Simply obtain a member key that provides access to features across our unified finance sites.

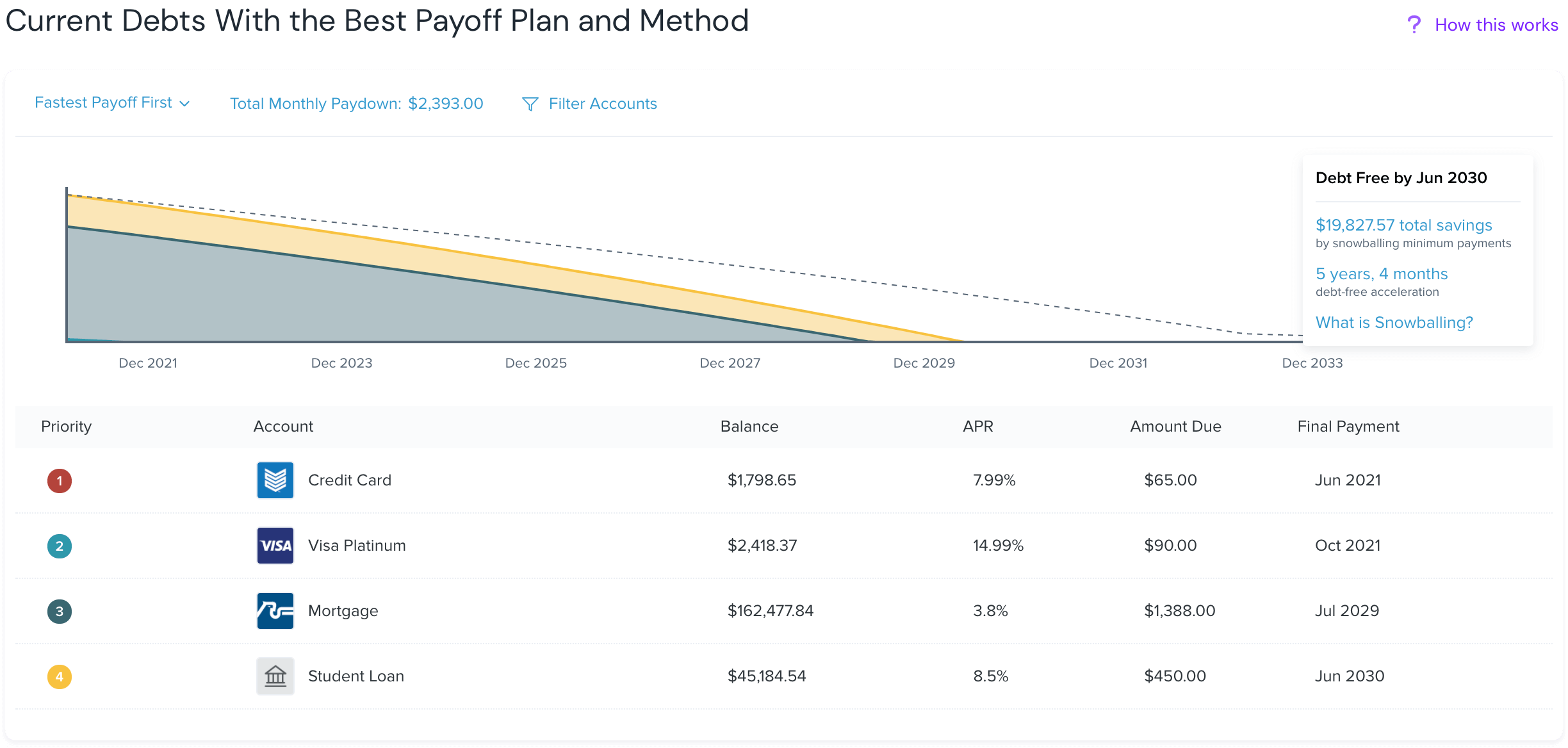

Set and Track Your Spending and Saving Goals

No more writing down your financial goals on a post-it note, or keeping them in notes on your phone. We created an app you can use for all your financial goals, and Billry is here for you to help you track your saving and spending goals, all in one place.

Get an Overview of all Your spending and income

Now, you can have information on all your spending, income, and savings in one app. Get customized analysis every day, week, or yearly to see where and how you spend your money. Use the reports you get to improve saving in various spending categories.

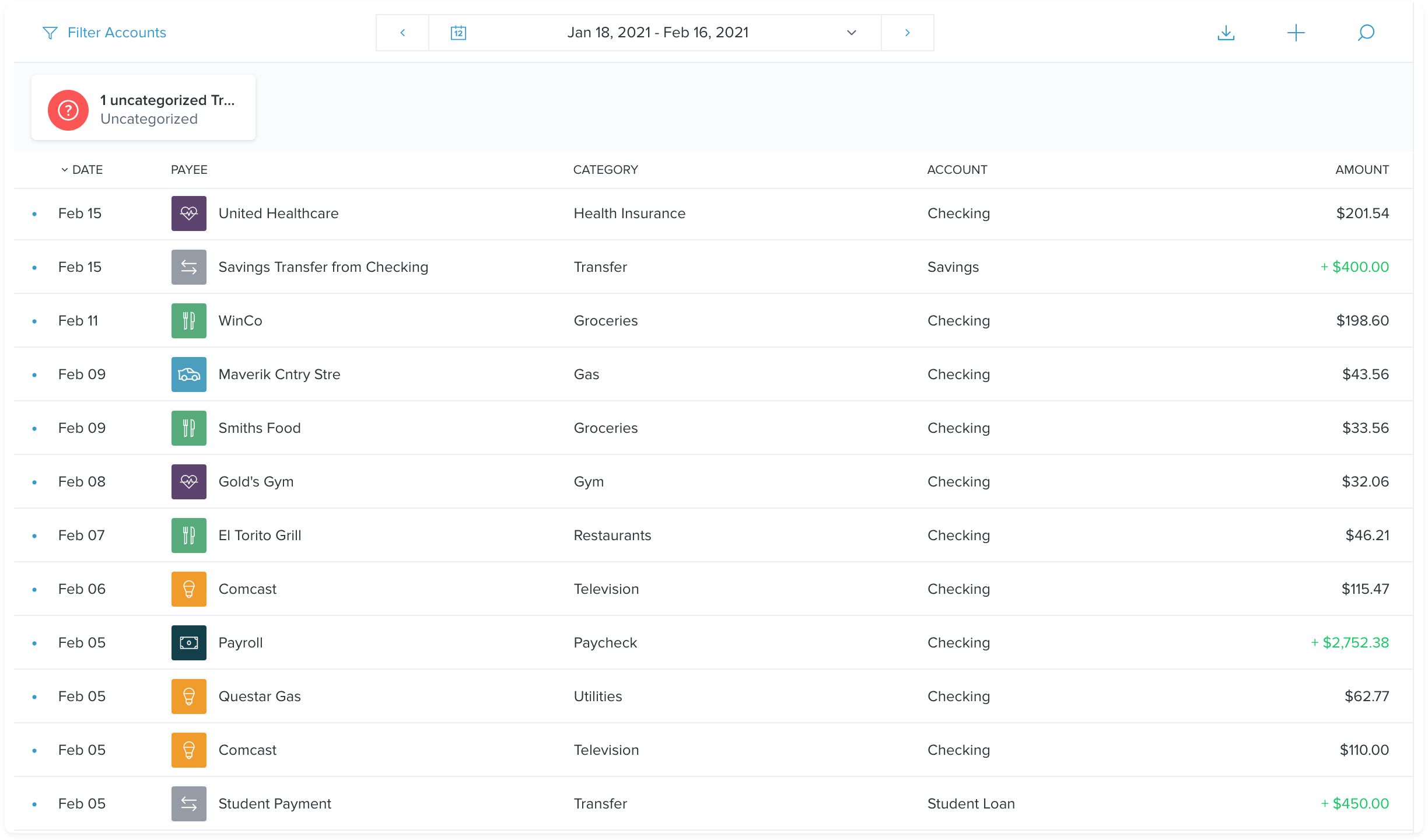

Keep track of your transactions in real time

Monitor all your transactions in one place. By connecting all your accounts to Billry, you’ll be able to oversee how and where you spend your money. You’ll never be surprised by a transaction on your report again.