Debt. The other four letter word.

Step up to Debt. When everything is one place, it’s easier to do transactions.

The Debtry store connects to your accounts and your money to help you organize. Debtry is one offer under your Goalry memer key across finance. Not all Debt is bad. Credit and Debt are in concert. Certain ratios can actually increase your credit profile. We give you a big picture view so you can take action across your money and credit to be more financially fit. Debtry ties into our money management features. You can see your account balance across all your accounts and make debt payments under one view. And whether you use just this one offer or many of ours, you’ll be able to keep up with your financial life so that you can enjoy what you enjoy.

With so many payments due from multiple companies having all of your accounts in one place matters. You can connect as many accounts as you want. Paying it down for an easier you!

Debt together, tied to everything finance and real estate.”

Consumer Debt

Consumer debt is what a person owes, as opposed to business or government debt. It’s also called consumer credit because debt has an effect on your credit. The Debtry store provides tools tied to your financial transactions and tons of great content to help you get out of Debt. We’ve also reviewed and rated many debt settlement and consolidation companies. We’ve done the homework!

Business Debt

Some companies choose to take on outside investment others take out debt to fund their business.

Business loan debt has many things in common with consumer debt. You need documentation, you loan shop, personal credit matters and you need to pay off your debt. We provide not only the business loan shopping tools, but also a complete library of the fundamentals of how to run a business on a budget and avoid debt whenever possible.

Debt management

It all starts with a plan designed with a payment schedule to reduce debts like credit cards into a single affordable payment. You will have to make an agreement and commit to stop using credit cards and other loans in exchange for lower rates and more manageable payments. There are many companies willing to help. We’ve reviewed these services to help you compare and shop.

We also offer plenty of do it yourself budgeting, savings and bill management solutions through other stores within the Goalry Mall. Let’s get started!

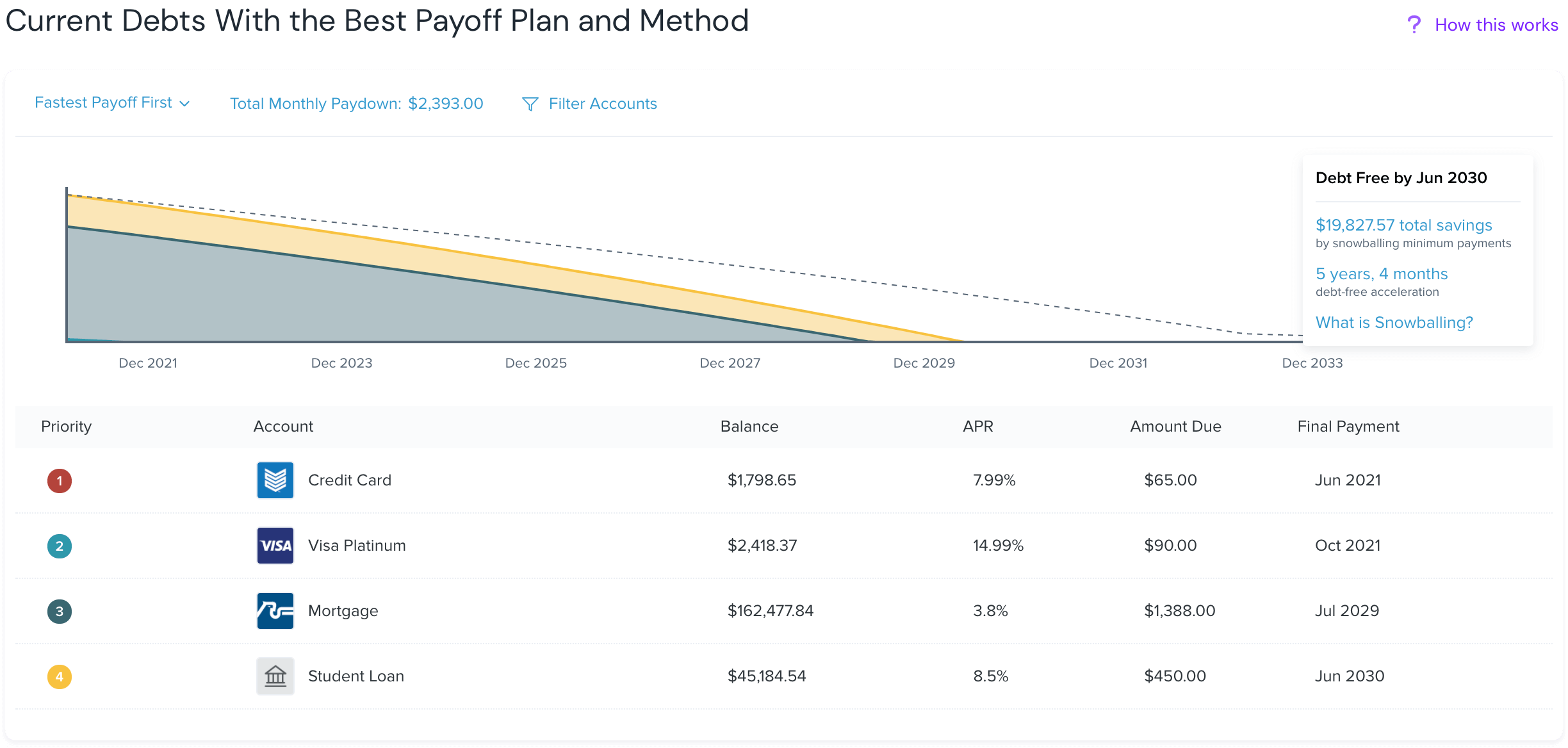

SET AND TRACK YOUR DEBT PAYOFF GOALS

The only way to actually pay off debts is to set a goal and create a plan. With Debtry, you can now do so easily, in one place. Set debt payoff goals, monitor your progress and stay on track to become debt-free.

MONITOR YOUR DEBT TO INCOME RATIO

With Debtry’s ‘Debt to Income’ tool, tracking this ratio is extremely easy. Connect all your account for most accurate results.

TRACK CURRENT DEBTS AND GET THE BEST PAYOFF PLAN OPTIONS

Not only can you monitor your debts and keep track of your payments, the Debtry store also helps you prioritize which debt you should tackle first, based on many factors. No more figuring out debt payoff plans by yourself.